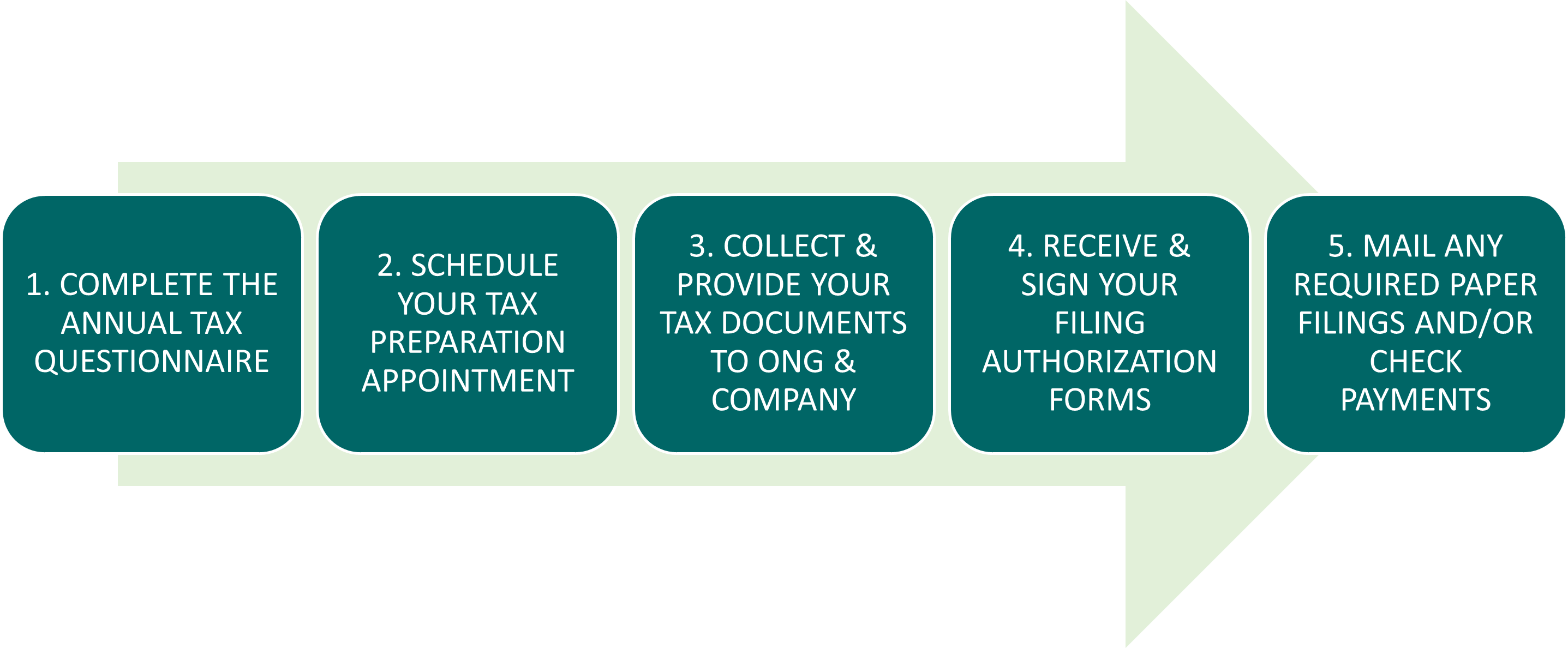

TAX PREPARATION PROCESS

We look forward to assisting you with your tax returns. An outline of our tax preparation process is provided below to assist you with collecting the information necessary for us to properly prepare your income tax returns.

1. COMPLETE THE 2024 TAX QUESTIONNAIRE

Click the link below to complete the Tax Questionnaire through DocuSign. You are welcome to complete a paper version of the Tax Questionnaire by downloading the PDF or completing it at our office.

2. SCHEDULE YOUR TAX PREPARATION APPOINTMENT

You are welcome to schedule your appointment with any of the team members listed on the scheduling page based on your preference and availability. Appointments can be in person at our office or virtual through Zoom.

3. COLLECT & PROVIDE YOUR TAX DOCUMENTS TO ONG & COMPANY

We will need copies of all the tax forms you receive. Provide our office with all tax documents through any of the methods listed below.

DROP OFF

Ong & Company

9225 Indian Creek Parkway

Suite 100

Overland Park KS, 66210